Sie möchten eine Steuer-ID in SeaTable hinterlegen? Kein Problem, über die Teamverwaltung ist dies in nur wenigen Schritten jederzeit möglich.

Hinterlegen der Steuer-ID

Eine Hinterlegung der Steuer-ID ist sowohl bei der Buchung eines Abonnements als auch nachträglich möglich.

- Öffnen Sie die Teamverwaltung.

- Wechseln Sie in den Bereich Abonnement.

- Klicken Sie auf “Rechnungsinformationen anpassen”.

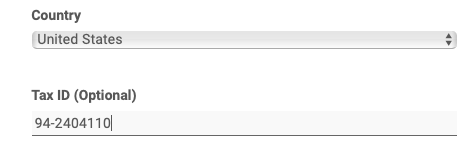

- Hinterlegen Sie im dafür vorgesehenen Feld eine Steuer-ID.

- Speichern Sie die Änderung mit Rechnungsempfänger ändern.

Automatische Prüfung der Steuer-ID

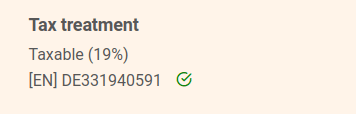

Nach dem Abschicken des Formulars wird Ihre Steuer-ID automatisch überprüft und gegen die von Ihnen angegebene Adresse verglichen. Die Prüfung kann mehrere Minuten dauern.

Erst wenn die Überpüfung erfolgreich war, wird die Steuer-ID wirksam und auf zukünftigen Rechnungen verwendet. Auch die Vorschau des zukünftigen Rechnungsbetrages wird erst dann angepasst, wenn die Steuer-ID als gültig verifiziert wurde.

Häufige Fragen zur Steuer-ID

Wird die Steuer-ID auf der Rechnung angedruckt?

Selbstverständlich. Wenn Sie eine Steuer-ID angeben, wird diese auf allen zukünftigen Rechnungen aufgeführt.

Meine Steuer-ID wird nicht akzeptiert?

Nach der Eingabe

Welche Bedeutung hat die Steuer-ID für Mehrwertsteuer?

Die Steuer-ID beeinflusst die MwSt. Berechnung bei zukünftigen Rechnungen. Bei einer gültigen Steuer-ID ein nicht-Deutschen Unternehmens wird die MwSt. auf 0% reduziert.