Klarna debts are currently being discussed extensively on social media and yet are often underestimated. The convenience of Klarna installment purchases lures younger people in particular into a seemingly endless spiral of debt. Perhaps your Klarna bills are piling up and you, like many others, are facing a mountain of debt. But don't worry, with a little discipline you can get out of debt.

In this blog post, we will take an in-depth look at the phenomenon of Klarna debt and provide you with practical tips and strategies on how you can get out of financial difficulties.

What Klarna is

Klarna is a Swedish financial services provider that offers online payment services and solutions for processing online purchases. The company offers its customers a wide range of options, including instant bank transfer, payment by installments and purchase on account.

With its slogan " Shop now. Pay later. slogan, Klarna has achieved an enormous reach, encouraging many consumers to make purchases in online stores without having to pay immediately. In turn, online store operators have the advantage that Klarna assumes the payment defaults of defaulting buyers so that e-commerce merchants receive their money in any case.

How Klarna debts arise

Klarna debts arise as soon as you opt for the payment methods purchase on account or Klarna financing (installment purchase). In this case, Klarna will present you with the amount for the products purchased and you must repay the amount within a certain period.

The lure of the buy now, pay later model tempts you more quickly than usual payment methods to make rash purchases for which you may not even have a budget. If you often pay by Klarna installment purchase, you also run the risk of losing track of your spending.

If you do not have sufficient liquidity on the due date, late payment fees and high debit interest can cause your Klarna debt to grow rapidly. In this way, you can fall into the debt trap faster than it seems at first glance.

The target group for Klarna installment plan

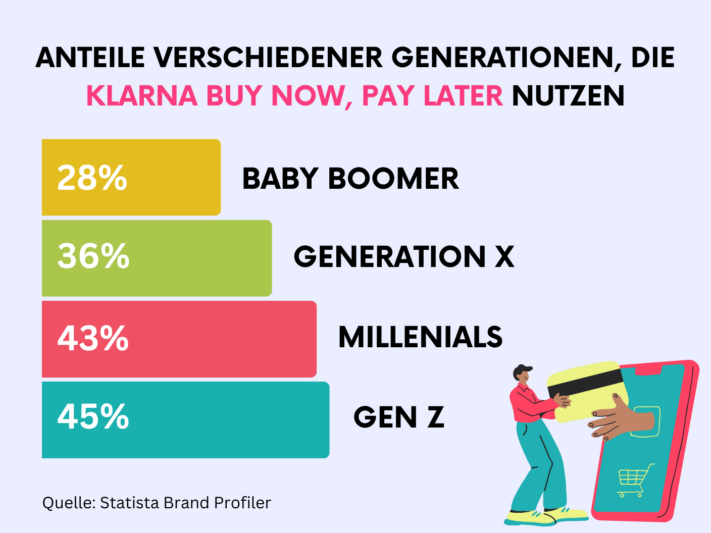

Klarna installment plan is used by a diverse range of people, including, according to a survey, mainly younger people from Generation Z and millennials. This age group appreciates the convenience and flexibility of Klarna payment services, especially the option to pay later. Many young people share their Klarna debts on social media under the hashtag #KlarnaSchulden.

Remarkably, a study by the Schufa Youth Finance Monitor shows that female young people use the buy-now-pay-later option significantly more often than their male peers. Half of the female respondents stated that they had already postponed a purchase in this way at least once, compared to only 38% of male teenagers.

What happens if you have Klarna debts

If you have missed a payment to Klarna, you will first receive three rem inders with a fee of 1.20 euros each. If you are unable to pay by the due date of the last reminder, Klarna will initiate debt collection proceedings. From this point on, you will no longer be able to pay with Klarna until your debt has been settled.

If you are still unable to make the payment, the amount can be spread over further installments to enable you to make a repayment. In this case, however, please note that Klarna installment loans are no longer free of charge and carry an interest rate of 11.95%.

Risks and effects of Klarna debt

Klarna debts not only involve the immediate burden of financial obligations, but also long-term risks that are often overlooked. In addition to the aforementioned costs of reminder fees and interest, which add to your debt, there are other consequences that you should consider. If your case is handed over to a debt collection agency, Schufa will also be informed. A negative entry in the Schufa can significantly downgrade your credit rating, which makes it more difficult to take out new loans, but also to find accommodation, for example.

Furthermore, Klarna debts can make future online purchases more difficult. In addition to blocking your Klarna account, other service providers may also deny you access until your debts are settled. Another aspect that should not be neglected is the psychological strain that debt brings with it. The constant financial pressure can lead to stress, anxiety and worry, which can significantly affect your quality of life and well-being.

How to get rid of your Klarna debts

Faced with Klarna debt, many feel helpless and overwhelmed. But there are concrete steps you can take to get out of this situation. By following a few important points and getting an overview of your finances, you can find your way out of the debt trap.

- Reduce spending: The first step to reducing Klarna debt is to stop making purchases through Klarna. It is important that you minimize your spending and realize that every additional purchase will only increase your debt burden.

- Get an overview of your debts: An accurate overview of your debts is essential. Make a note of not only the amount of your debts, but also which providers you have debts with and at what interest rate.

- Create a budget plan: With this overview, you can now create a detailed budget plan. List all your income and expenditure and identify areas where you can reduce expenditure. You should also think about how you can increase your income. A solid budget plan is crucial to getting your finances under control.

- Pay off debts: You can now tackle your debts with the financial surplus you achieve by reducing expenses or increasing income. Negotiate with Klarna and agree repayment terms that are acceptable to you. Prioritize debts with higher interest rates to minimize interest costs in the long term.

If you feel completely overwhelmed and don't have a clear overview of your finances, don't be afraid to seek professional help. Debt counseling can help you develop a plan to get your finances back under control and manage your Klarna debt in the long term.

How to avoid debt

To avoid future debts and create a solid financial foundation, you should apply some proven strategies. A regularly prepared budget and consistent monitoring of your spending are essential. This will help you keep track of your financial situation and minimize unnecessary spending.

It is also advisable not to be overly influenced by advertising promises and tempting offers. Products or services are often advertised that are not actually necessary. Make rational decisions and only buy what you really need. In addition, setting aside a nest egg for unforeseen expenses can increase your financial security and prevent you from having to resort to loans or installment payments in an emergency.

Klarna itself also offers the option of setting budgets to keep your spending under control. Alternatively, you can choose not to pay in installments and only pay in advance or by instant bank transfer to ensure that you only spend money that you already have.

Budget book from SeaTable

A well-structured budget book is extremely useful for recording and analyzing your expenses in detail. SeaTable offers a free template that allows you to keep your financial affairs under control without losing track.

With SeaTable's budget planner, you can easily record all your expenses and income and calculate your budget. Distinguish between one-off expenses and regular costs to get a clear overview. Whether it's monthly streaming services or spontaneous leisure activities - you can enter everything in your budget planner. In this way, you can analyze your consumer behavior and identify your savings potential.

Thanks to the practical calendar, you can also keep an eye on the due date of certain expenses so that you don't miss any payment deadlines and aren't surprised by unexpected direct debits.

Say goodbye to your Klarna debts by managing your finances effectively and keeping track of your expenses. All you need to do is register for free with SeaTable, create a new database using the template and then enter your own data.